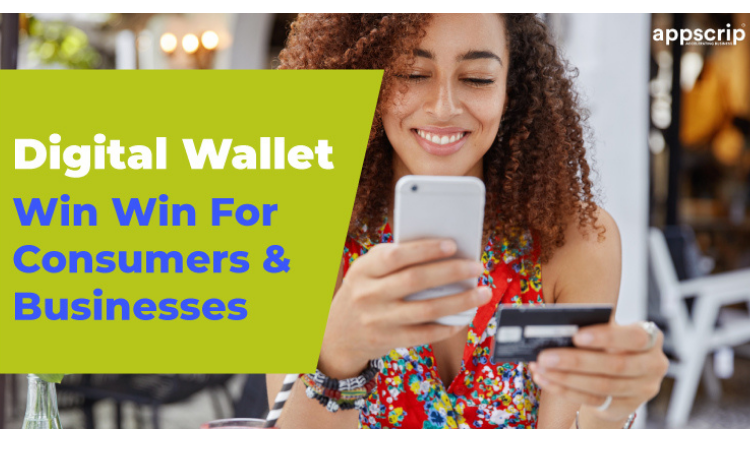

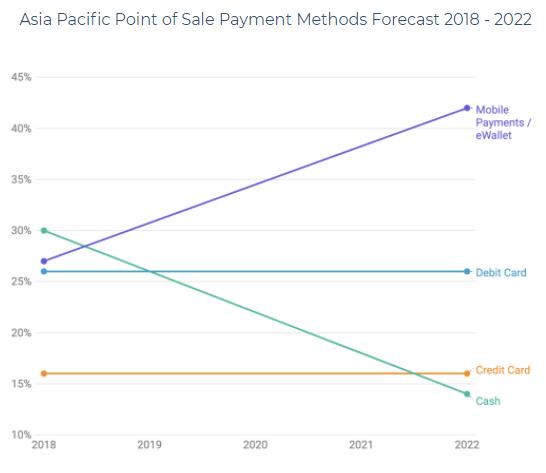

With convenience being the hallmark of all decisions on imbibing technology, it is surprising that the digital wallet took so long to gain traction.

As the usage of smartphones grew exponentially consumers became reliant on them for complicated and mundane chores. To enable their behavioural trends, businesses have developed digital wallets as a new channel for sales, marketing and primarily, relationship-building.

What is a Digital Wallet?

Digital wallets allow users to store funds, make transactions, and track payment histories. Digital wallets principally eliminate the need to carry a physical wallet by storing all of a consumer’s payment information securely and compactly. Digital wallets are predominantly used in combination with mobile payment systems so that customers can pay for purchases using their smartphones.

Cryptocurrencies rely exclusively on digital wallets to maintain balances and carry out transactions.

Digital wallets are also utilized to store loyalty card information and digital coupons. It is essentially an online rendering of your regular wallet and tasks such as a payment can be done in the wink of an eye. Apple Pay / Google Pay has got your bank cards stored in one place along with your other brand loyalty cards.

Digital Wallet Explained

A digital wallet (or e-wallet) is a software-enabled system that stores users’ payment information and passwords securely for various payment methods and websites. Setting up a digital wallet should be after enough research as customers fathom that loyalty programs encourage them to spend more. Hence why would they be keen to sign up with you? Creating that need is how you garner more users.

Look up how different rewards would ultimately affect your business as well as your consumer’s purchase behaviour; you want to be able to offer various forms of benefit.

Digital wallets allow the acceptance of payments for services performed. It also helps to receive funds or remittances from friends/relatives/family located anywhere in the world. Digital wallets are not restricted for lack of a bank account with a physical branch or outlet, hence people from far off regions or rural areas can connect to this facility.

Getting Digitally Started

Digital wallets are a blessing in disguise to companies that collect consumer data by which firms know more about their customers’ buying habits. This effectively helps firms to market efficiently to customers. But of course, this has a downside for consumers – a loss of privacy for them.

In fact in Melbourne, Google Pay has taken the initiative and added Public Transport cards within Android phones. Now, all that patrons need to do to pay for their travel is via the mobile phone (which is always easy access) instead of rummaging for their card through personal belongings.

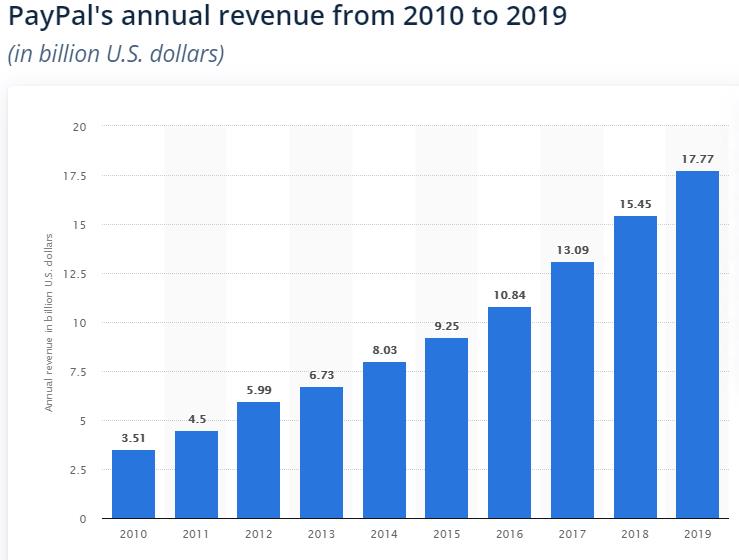

PayPal is perhaps one of the biggest and the best common examples of a digital wallet, being one among the first.

92% of the Australian population own a smartphone, therefore it is time businesses took notice of the situation and jumped into the tech bandwagon. Or they are certainly going to fall far behind when it comes to building customer loyalty.

As mentioned earlier, digital wallets can help majorly with three domains:

-

Sales

We really can’t say enough regarding convenience to consumers when it relates to buying. The easier you make the buying process, the more likely a consumer will go ahead and finish a sale. Most businesses are being pushed to go online due to the COVID situation prevailing the world over right now.

Therefore, assuring your clients that your online sales channel is open, secure and easy to use is a guaranteed manner to make them delighted and open up those wallets.

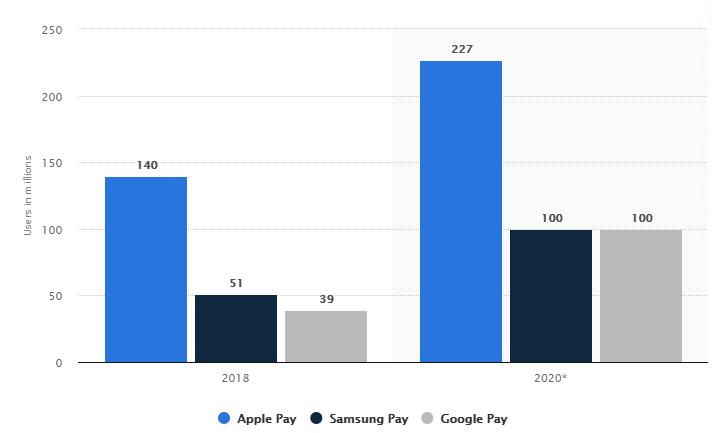

But be sure to pick popular digital wallets to collaborate with. Do the much-needed research and find out which wallet has widespread utilization with your client demographic. If you’re unsure regarding which particular option to pick, then investigate and track which one is getting to most of your consumers and why.

Be sure to winnow your data, this will help you fathom your customers with surprising results.

-

Marketing

The digital wallet in most cases does not make a direct connection to marketing and that is the reason it remains an untapped channel. However, as in online coupons or codes, digital wallets offer marketers the rare opportunity to begin popping up to customers with customised text. This really depends on which part of the customer journey they figure in.

For example, while posting potential marketing messages to new customers, ideally it should be different from that which is being sent to an existing customer. You can choose to offer existing customers a discount code / a quick last minute deal on a product you know that they are assured of buying.

While that which is being offered to a future customer could be a look at the range of goods available with a potential offer to discount any first purchase within a given time frame.

-

Relationship Building

For any business to grow, building customer loyalty is an imperative and integral part of the marketing process. Digital wallets assist in making this a wee bit easier. It has been shown that consumers appreciate add-on benefits such as loyalty points and coupon codes.

You could go on ahead and create an online version of a loyalty card, consumers are then more likely to become frequent users of this option. For example, Woolworths made their Loyalty Card digital, thereby allowing customers who use Google Pay to redeem points / collect them, without having to pull out a physical card.

Special offers can be personalized with each digital wallet, allowing firms to build better customer relationships to run their course. Considering how quickly technology is transforming businesses, adapting to consumer needs and influencing consumer behaviour is relevant. Therefore learning the ropes of the digital wallet is essential if you’re looking to make a serious dent in your niche.

Conclusion – Digital Wallet

Users can utilize a digital wallet to complete their purchases easily and quickly empowered by near-field communications technology. Stronger passwords can be created without really worrying about how to remember them later. The process can be helped by building an app that will streamline it.

Gamifying or brand collaboration makes the process considerably rewarding in an innovative manner to gain traction. Digital wallets are also an imperative interface for using cryptocurrencies such as Bitcoin. But consumers aren’t yet leaving their physical wallets at home.

Businesses and consumers are excited about the possibilities and expansions that are available within this field. Taking advantage of the opportunities that a digital wallet presents to businesses is imperative to stay abreast amongst your competition.

After an Engineering degree and a Diploma in Management I devoted 16+ years working in the automotive industry. My innate skill and extreme passion in writing, encouraged me to adopt it up as a profession. I have been writing for more than 10+ years in the software industry. The 400+ blogs I published are informative, exhaustive and interesting to a professional and causal reader.