Several Chinese startup platforms have gone big in recent times, recording tremendous year-on-year growth, and influx of millions of active users.

While Alibaba is the greatest example, another company, Pinduoduo, has been making waves in the Dragon nation, amassing the largest number of active users. Social commerce and affiliate marketing fits into the Pinduoduo business model.

Pinduoduo is an e-commerce platform that has gained immense popularity in China since its launch in 2015. The platform has disrupted the traditional e-commerce business model by introducing a social commerce concept that focuses on group buying, referral marketing, and gamification. In this blog, we will explore the Pinduoduo business model, how it works, and the reasons behind its success.

Pinduoduo earns money from several online marketing services, transaction services, and merchandise sales. The company functions as per the marketplace business model. What this business model is, it matches buyers with suppliers. The suppliers are the merchants on its platform. It then earns revenue for fostering those transactions.

Though the agriculture-based e-commerce platform is yet to bag its place outside China, the US has already listed Pinduoduo on its stock exchange.

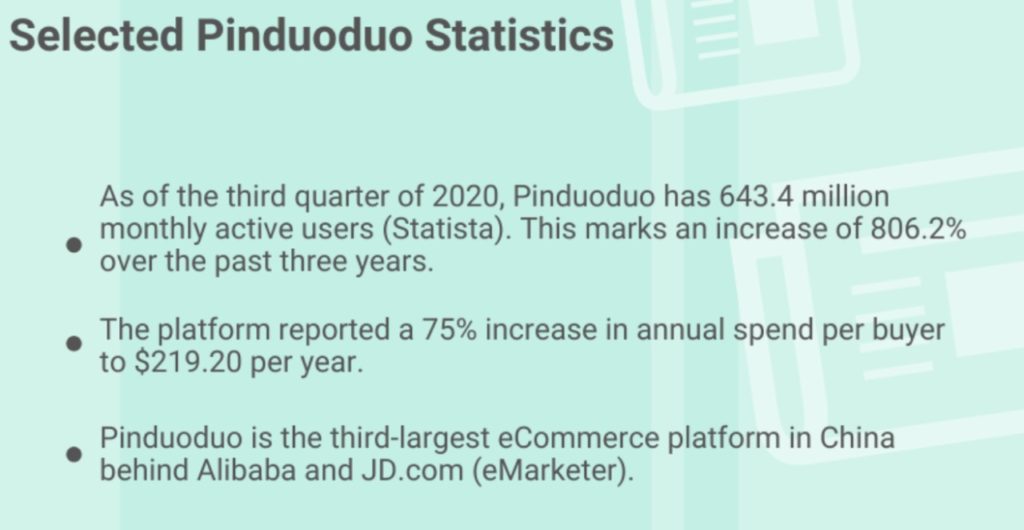

Over the years, Pinduoduo has registered a staggering growth, which, some suggest, may be even faster than its established counterparts, such as Alibaba and JD.

The Pinduoduo Business Model

Pinduoduo’s business model is based on three key principles:

Social Commerce: Pinduoduo combines social networking with online shopping, making it a more interactive and engaging platform. Users can share product links with their friends and family, create shopping groups, and invite others to join the group to avail of discounts.

Group Buying: Pinduoduo encourages group buying, where users can team up with their friends or family to purchase products at lower prices. The more people join the group, the bigger the discount they can get.

Gamification: Pinduoduo uses gamification to make shopping more fun and engaging. Users can participate in games and challenges to earn coupons and discounts.

About Pinduoduo Business Model

In 2015, Chinese businessman, and philanthropist, Colin Huang (Huang Zheng), established Pinduoduo, an agriculture e-commerce marketplace, to help farmers sell fresh produce without mediators. With the pandemic and subsequent lockdowns, fresh produce, which was earlier not in demand as much as electronics, or clothing, witnessed a considerable spike.

With 788.4 million active users, Pinduoduo is currently the most sought-after Chinese e-commerce platform, surpassing even Alibaba, with 779 million active users.

How Does Pinduoduo Work?

Pinduoduo works on a simple model. The platform connects buyers directly with manufacturers and suppliers, cutting out intermediaries, and reducing costs. Here’s how the platform works:

Users can download the Pinduoduo app and create an account.

They can browse through the product categories and select the items they want to purchase. Users can choose to buy the products alone or team up with their friends to purchase them at a lower price.

Once the group is formed, the users can place their orders, and the platform will process them.

The products are shipped directly from the manufacturer to the users, cutting out intermediaries and reducing costs.

The Pinduoduo Business Model

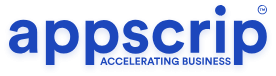

Pinduoduo business model appeals to its users through its group buying function, where hundreds of users can bid, and buy items at low prices.

However, group buying requires a minimum number of users to complete the transaction. Also, if the item purchased through group buy does not meet this requirement within 24 hours, the order gets cancelled.

Besides the group buy model, users can also buy items directly at the indicated prices.

The Pinduoduo business model relies on three distinct revenue streams.

Online Marketing Services

A significant portion of Pinduoduo’s revenue comes from the online marketing services. These services allow users to bid for keywords that match the product listings appearing in search results.

Search engines, such as Google, then place relevant ads on the company’s platform via banners, links, and logos through an online bidding system that determines their placement and prices.

Besides this, Pinduoduo also lets users discover new products on its platform by putting them on the first page or feed. The firm has put together several algorithms that allow it to learn about its users.

The users browsing history is utilised to fathom their purchase experience and recommend relevant products based on their preferences.

So, in this way, the company achieves higher conversion rates, and sales, through its dedicated e-commerce platform.

Reasons Behind Pinduoduo’s Success

Pinduoduo’s success can be attributed to several factors:

Group Buying: Pinduoduo’s group buying feature has been a huge hit with Chinese consumers. The platform’s group buying model allows users to purchase products at lower prices, making it an attractive option for cost-conscious shoppers.

Referral Marketing: Pinduoduo’s referral marketing strategy has been instrumental in its success. Users can earn discounts and coupons by inviting their friends and family to join the platform, creating a viral effect that has helped the platform grow rapidly.

Low Prices: By connecting buyers directly with manufacturers, Pinduoduo can offer products at lower prices than its competitors. This has made the platform popular with price-sensitive consumers.

Social Commerce: Pinduoduo’s social commerce concept has made shopping more interactive and engaging, creating a more enjoyable shopping experience for users.

Transaction Services

Besides generating revenue through paid advertising, Pinduoduo also charges users a commission or fee for every item they purchase through its platform.

The transaction fees for such purchases are significantly lower than most other e-commerce platforms, including JD, and Taobao, owing to the overwhelming number of transactions occurring through group buying.

For the Pinduoduo business model each buyer receives a commission when they purchase items off the platform, the company generates significant revenue through this model.

Furthermore, the upcoming e-commerce platform also lets its users play games and get discounts on different products. These games contain ads and Pinduoduo makes money each time users click on them.

Likewise, the online platform also relies on another transaction-based system to make money. In this system, Pinduoduo lets users buy items on its platform through dedicated wallets.

The platform generates revenue each time users pay for products using the dedicated wallet.

Merchandise Sales

Besides online marketing services and commission-based transactions, Pinduoduo also depends on its merchandise sales revenue model to make money. For this, the company uses another platform called Duo Duo Grocery, to sell fresh produce.

Duo-Duo Grocery connects its users to more than 16 million farmers from countries like Australia, Germany, and China.

These countries have small-scale farms, and Pinduoduo invests a significant amount from its cash balances into its Duo Duo Grocery platform. In doing so, the e-commerce company enables farmers to buy sophisticated equipment and yield better crops.

Moreover, the platform also lets farmers promote their produce via live streaming solutions.

The e-commerce player also provides training to both new and established farmers on its platform, allowing them to reap greater benefits.

Funding and Valuation

According to Crunchbase, the Chinese agriculture-based e-commerce marketplace, Pinduoduo business model has raised $3.8 billion across six equity and debt funding rounds.

Several notable players participated in the company’s growth, including Sequoia Capital China, Tencent, Cathay Innovation, and Hillhouse Capital Group.

In July 2018, Pinduoduo raised another $1.6 billion when it went public. The platform, currently valued at $115 billion, is working hard to help farmers secure their future.

Conclusion: Pinduoduo Business Model

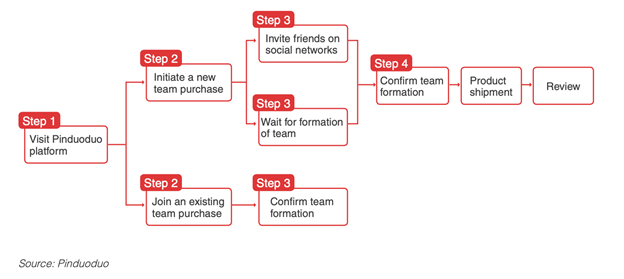

Pinduoduo has disrupted the traditional e-commerce business model in China by introducing a social commerce concept that focuses on group buying, referral marketing, and gamification.

The platform’s success can be attributed to its low prices, group buying feature, referral marketing strategy, and social commerce concept. As Pinduoduo continues to grow, it will be interesting to see how the platform evolves and how it continues to disrupt the e-commerce industry in China.

The Pinduoduo business model adopts several strategies that enable the platform to make lots of money and achieve high conversion rates.

However, the booming e-commerce platform makes the most money out of its group buying model that allows users to buy in groups of hundreds or even thousands.

Pinduoduo’s group buying business model is the most successful, primarily because it works alongside the transaction model, allowing the company to generate significant commission-based revenue.

Pinduoduo has almost raised $3.8 billion over six rounds of debt and equity funding.

Prominent investors include Cathay Innovation, Sequoia Capital China, Hillhouse Capital Group, Tencent, and several others.

Pinduoduo went public in July 2018. During that time it was able to raise $1.5 billion. Pinduoduo’s business was valued at $24 billion after that. Now its valuation has risen to $115 billion.

During 2020 fiscal year, Pinduoduo recorded literally $9.1 billion in revenue which is 96% up from the previous year.

After an Engineering degree and a Diploma in Management I devoted 16+ years working in the automotive industry. My innate skill and extreme passion in writing, encouraged me to adopt it up as a profession. I have been writing for more than 10+ years in the software industry. The 400+ blogs I published are informative, exhaustive and interesting to a professional and causal reader.