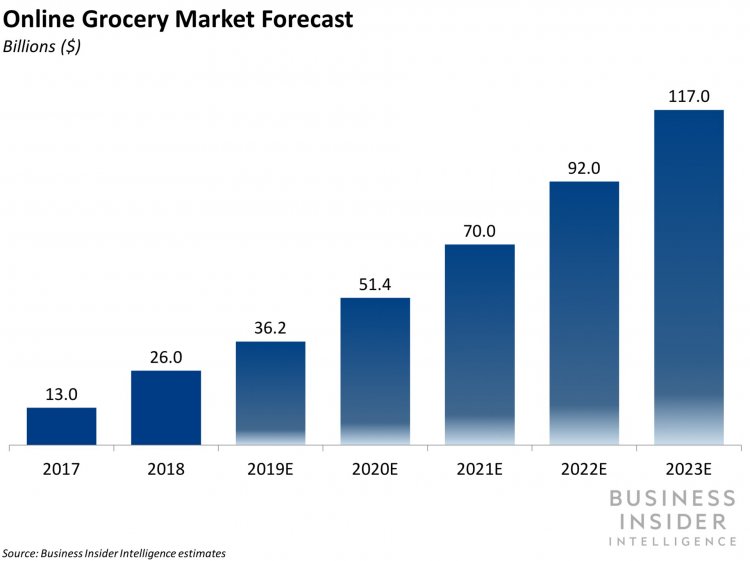

Online grocery is growing rapidly from its small base. Its market value has doubled from 2016 to 2018, suggesting that consumers are starting to get more comfortable ordering essentials and certain foods online — a major barrier to adoption.

[spacer height=”10px”]

[spacer height=”10px”]

Grocers are rushing to take advantage of this potential, resulting in a highly competitive market. Both established grocery players and newcomers to space are expanding their curbside pickup and delivery offerings — the two basic components of online grocery — in an attempt to grab market share.

[spacer height=”10px”]

They’re each employing different strategies to find success: Amazon is leaning on its e-commerce and fulfillment capabilities to offer a variety of online grocery services, for example, while Walmart is using its strong brick-and-mortar footprint to its advantage. Kroger and Aldi, are working with third parties such as Instacart to provide their services.

[spacer height=”5px”][adrotate banner=”5″][spacer height=”5px”]

Global Grocery Delivery Market 2019 Size

Online grocery currently comprises a small portion of grocery overall but is on a rapid rise. Adoption is still fairly low, with about 10% of US consumers saying that they regularly shop online for groceries, according to NPD.

[spacer height=”10px”]

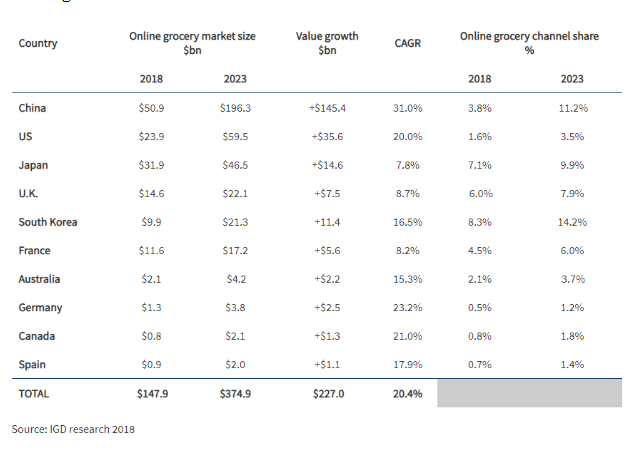

Ten leading global online grocery markets are predicted to experience combined growth of $227bn, at an annual rate of 20%, by 2023, ~ IGD today at a Grocery shop in Las Vegas.

As the global leader in grocery eCommerce, China will grow at a 31% CAGR over the next five years, taking market share from 3.8% to 11.2%. Over the next five years, the Chinese online grocery market will grow by the same size as the entire combined market of all ten countries in 2018.

[spacer height=”10px”]

IGD also forecasts extensive growth in the US with online set to more than double its market share, driven by the rapid expansion of pick-up points, Instacart’s expansion and integration of businesses such as Ship and Home Chef. Market share will grow to 3.5%, creating an additional $37bn opportunity for American retailers and manufacturers.

[spacer height=”10px”]

Grocery Delivery Market Trends Across Regions

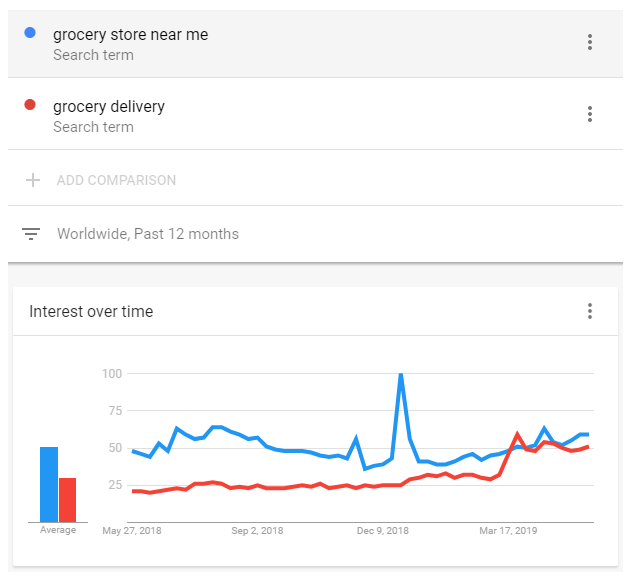

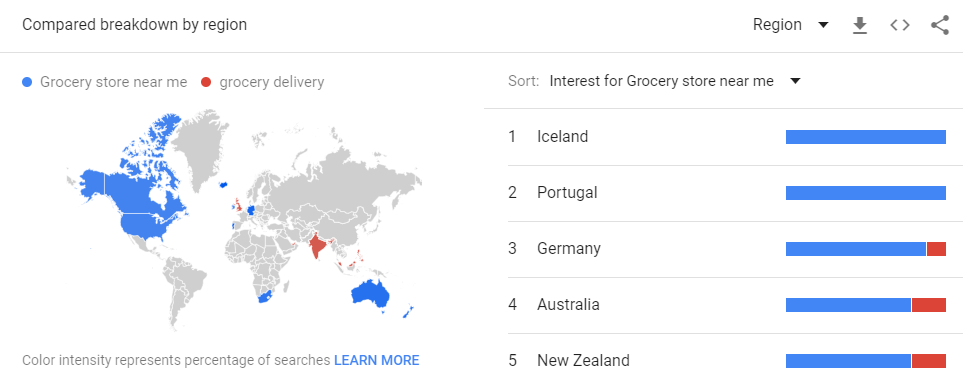

To understand the grocery delivery trend we used Google trends to understand the consumer’s behavior over the past 12 months.

From the image given below, you see that it’s catching up with the traditional methods of grocery shopping.

[spacer height=”10px”]

[spacer height=”10px”]

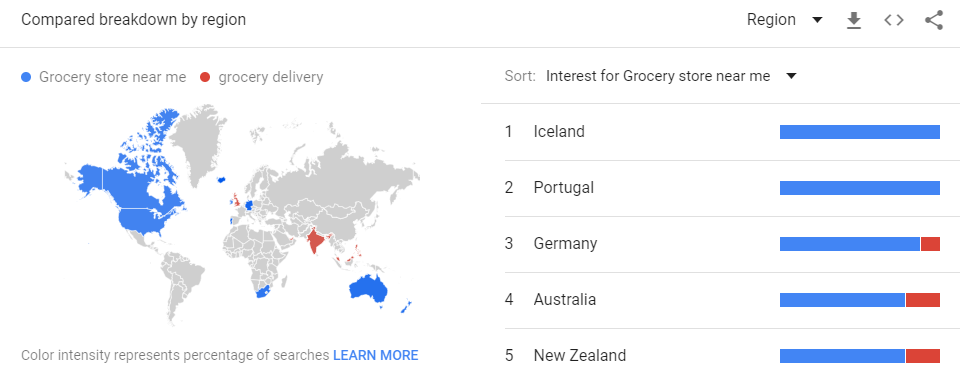

If we talk about the regional analysis then it also showing similar trends.

From the image given below, you can understand that consumers behavior across different regions.

[spacer height=”10px”]

A further breakdown shows us how consumers of major cities worldwide are shifting towards online grocery shopping.

From the trends given above, we can conclude that the online grocery market has almost occupied 50% of the market.

Global Grocery Delivery Key Players

The key players of global grocery delivery markets are Aldi, Amazon, Instacart, Kroger, Ocado, Postmates, Target, Walmart & Whole Foods

[spacer height=”10px”]

| Key Players | Their Journey |

|

|

AldiCommon brand of two German family-owned discount supermarket chains with over 10,000 stores in 20 countries and an estimated combined turnover of more than €50 billion. |

|

|

AmazonAfter testing its grocery operation for 5 years in Seattle Amazon started to expand its business in other parts of the world. Currently sells a lot of beverages and snacks, but it’s yet to become a truly profitable full-basket grocery shop. |

|

|

GrofersAn Indian online grocery delivery service founded in December 2013 and is based out of Gurugram. Raised a total of $441.8M in funding over 7 rounds. Amid a multifaceted war in the grocery delivery segment, the revenue earned in FY18 was Rs.53.47 crore, 57.7% up from Rs.33.92 crore in FY17. |

|

|

InstacartAmerican technology company that operates as same-day grocery delivery and pick up service in the U.S. and Canada. Raised a total of $1.9B in funding over 11 rounds. Brought in 207% more January revenue than Shipt and 662% >AmazonFresh. |

|

|

KrogerIn August 2018 it introduced Kroger Ship a direct-to-customer e-commerce platform that enables consumers to order from a selection of groceries at ship.kroger.com and have them delivered to their door. Till now Kroger has acquired 11 organizations. They acquired Home Chef for $200M. |

|

|

OcadoIts an English online supermarket. In contrast to its main competitors, the company has no chain of stores and does all home deliveries from its warehouses. Has raised a total of £143.2M in funding over 2 rounds. |

|

|

PostmatesSan Francisco-based Postmates launched in 2011 by co-founders Sam Street, Sean Plaice and Bastian Lehmann, who is also the company’s CEO.

The company is considered a pioneer in the on-demand delivery industry and currently services 2,940 cities across the US and Mexico.

Till now Postmates has raised a total of $678M in funding over 11 rounds.

|

|

|

TargetTarget Corporation is the 8th-largest retailer in the United States and is a component of the S&P 500 Index. Groceries account for nearly 20% of Target’s revenues |

|

|

WalmartOperates a chain of hypermarkets, discount department stores, and grocery stores. Headquartered in Bentonville, Arkansas. It has acquired 21 organizations. For the fiscal year ended January 31, 2019, Walmart’s total revenue was $514.4 billion. |

|

|

Whole Foods MarketA supermarket chain owned by Amazon that exclusively sells natural and organic products. $16B in estimated revenue annually. Competes with Wegmans Food Markets Inc., The Fresh Market, and Giant Eagle. |

[spacer height=”10px”]

Opportunity & Right Time To Start

As a bricks-and-mortar grocer, in addition to the threat posed by online grocery, there is also an opportunity to reach new customers and grow sales through this format.

| Your current assets and know-how give you the advantage to seize this opportunity rapidly. If you aren’t already running an online channel, we believe you should be thinking seriously about your options. |

| And if you are already active in this channel, you should be thinking about how to evolve your offer and defend against future disruptive forces, such as the internet giants making a play in your market. |

| If online grocery is not yet established in your market, it is absolutely true that taking some of your business online will cannibalize more profitable sales in your bricks-and-mortar stores. |

| But since online is a model that can be profitable in many markets, it is fair to assume that someone will soon be serving those markets. For established players, the choice is losing profitable bricks-and-mortar sales to someone else, or to their own online operation. |

| Delay will make entry more difficult, risky, and expensive, as late movers in France and the UK are finding. |

[spacer height=”10px”]

The right time to launch depends on your market, and a key consideration is that the economics of online grocery requires rapidly reaching scale in order to be successful.

| The advantages conferred by scale make the financial benefit from moving first very significant. As you look at your portfolio of assets and the markets they cover, start by looking at the places where you have a chance to be a first mover. |

| If you are in a mature market such as the UK or France, there may be no place where this is possible. However, if there is not already a dominant player in your market, investing first is likely to deliver a better return on investment. |

| When planning the roll-out of an online business, the focus should be on driving full utilization from all of your fixed costs, such as distribution centers, delivery fleets, and marketing spend. |

| This means a plan that concentrates on winning relatively high market share in geographically concentrated areas before expanding to nearby areas – and that requires investment ahead of growth. |

| You may also want to over-invest in delivering a high-quality service experience to ensure customer trial turns into customer acquisition even while you are still working out some of the kinks in your processes. |

[spacer height=”10px”]

Concluding Remarks

| Though online grocery has been around for years, it is only now starting to gain traction in major markets. Our analysis suggests these formats can be profitable in much of the US and Western Europe. |

| Their evolution in France and the UK shows how fast they can grow, and now major players such as Amazon are investing heavily in the US and Germany. |

| Even in markets where online grocery is relatively mature, new and well-capitalized entrants could make a significant impact. The growth of this format does not mean the end of bricks-and-mortar grocery, but it will be highly disruptive. |

| As established players lose market share, stores will need to close, while in many cases the stores that remain may become more profitable than before as local rivals disappear. |

| Bricks-and-mortar grocers, therefore, should focus not on outrunning the “bear” of online grocery but rather on outrunning the person next to them, their local competition. |

| Although online grocery certainly poses a threat to a bricks-and-mortar grocer, it also presents an opportunity. Bricks-and-mortar grocers have assets, brands, and expertise that can be used to launch an online business more rapidly than an online-only player. |

[spacer height=”10px”]

While entering the online business is clearly risky, it can also allow an established retailer to reach new customers, serve different purchase occasions, and increase loyalty. Bricks-and-mortar stores should carefully consider the opportunity to start, grow, and upgrade their online offerings to take advantage.

Get the best multi-store Grocery shopping & delivery business software solution. Click Here.

[spacer height=”5px”][adrotate banner=”2″][spacer height=”5px”]

Digital marketing consultant, helps clients generate leads, drive site traffic, and build their brands through useful, well-designed marketing strategies.