Alibaba’s revenue model has enabled them to become not only China’s leading e-commerce company but also a prominent player in the global market. This article will dissect Alibaba revenue model, explore its different revenue streams, and delve into its growth and success.

Alibaba’s Business offerings

Alibaba’s business model is structured around different segments as part of their diverse product and service offerings. These segments serve different markets and have different monetization strategies.

Alibaba

Alibaba.com is the company’s business-to-business (B2B) platform that connects buyers and suppliers globally. This platform primarily caters to large corporations involved in substantial trading in terms of quantity and value. Alibaba.com has been particularly helpful in providing Chinese manufacturers and suppliers with a platform to sell their products and services internationally.

The company also provides additional services along the supply chain for imports and exports, such as customs clearance, VAT refund, trade financing, and logistics. In addition, they can pay for premium options like boosted site visibility and an unlimited number of product listings.

Taobao

Regarded as the jewel in Alibaba’s crown, Taobao is the company’s most extensive site. This consumer-to-consumer (C2C) platform facilitates small entrepreneurs in offering their products to a global audience.

On Taobao, both buyers and sellers pay no fees to make purchases or sales. The site operates similarly to Google in that it returns results based on the user’s keywords and that businesses pay to be featured more prominently than their competitors. Each seller’s success rate is displayed on the site using a unique grading system.

Tmall.com

Tmall.com serves as a portfolio of high-end brands. This platform is designed for China’s affluent middle and upper classes who are willing to spend on top-quality products.

Tmall features over 3700 product categories and has more than 500 million monthly active users. Tmall provides its vendors with analytics that provide information, including traffic, pageviews, and ratings from customers.

In Q3 FY 2022, the ecommerce division (includes Alibaba, Taobao and Tmall) totaled $27.0 billion. Almost 71% of the company’s overall revenue and almost all of its adjusted EBITA come from this division.

Cainiao

Cainiao is Alibaba’s domestic and international one-stop logistics service and supply chain management solution. This segment addresses the varying logistic needs of merchants and consumers.

The Cainiao division saw a 15.1% YoY growth in revenue to $2.1 billion in Q3 FY 2022. An adjusted EBITA loss of $14 million was recorded for the division, which is a decrease of more than two and a half times from the adjusted EBITA loss reported for the same quarter a year ago. More than 5% of total corporate revenue comes from this division.

Cloud Computing

Alibaba’s cloud segment, Alibaba Cloud, offers a complete suite of cloud services globally, including database, storage, network virtualization, security, management and application, big data analytics, and other services.

The cloud division’s Q3 FY 2022 sales of $3.1 billion was up 20.4% year-over-year. After reporting a deficit in the same statistic a year ago, it earned a profit of $21 million this time around. About 8% of overall sales and a minor percentage of adjusted EBITA comes from this division.

Alibaba Monetization methods

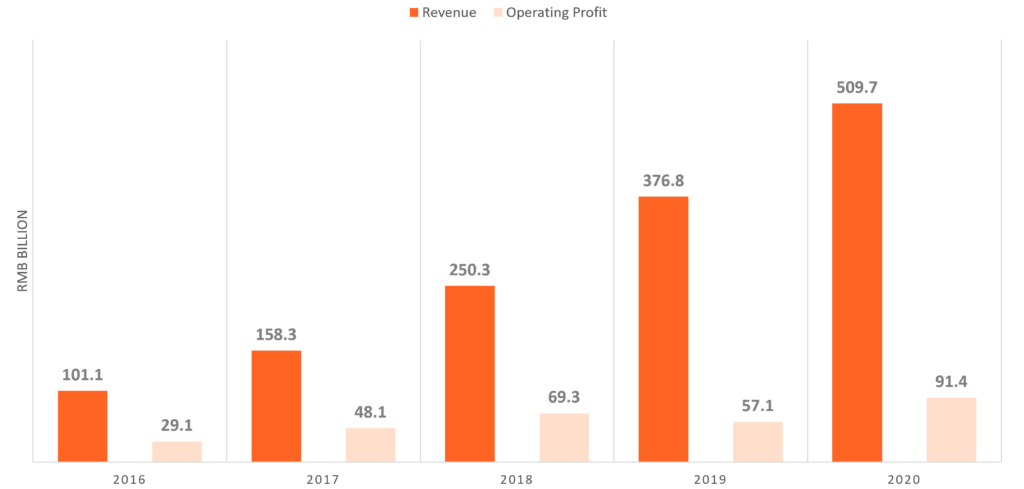

Alibaba’s financial results have shown a mix of growth and challenges. For instance, in the third quarter of the 2022 fiscal year, the company reported a 9.7% YoY rise in revenue to $38.1 billion. However, its net income attributable to ordinary shareholders fell by 74.3% to $3.2 billion during the same period.

Alibaba’s business model generates revenue primarily from three avenues: online marketing services, commissions on transactions, and membership and value-added services.

Online Marketing Services

Alibaba offers various online marketing services. These include pay-for-performance marketing, display marketing services, the Taobaoke program, and placement services. Sellers pay marketing fees to acquire user traffic and promote their products or services.

All Gold Supplier members must meet strict criteria in order to maintain their elite status. Third-party credit reporting companies also conduct a thorough authentication and verification process.

Commissions on Transactions

In addition to online marketing services, sellers on Tmall and Juhuasuan also pay a commission based on the gross merchandise volume (GMV) of transactions settled through Alipay. Alibaba also earns revenue from commissions on transactions over AliExpress.

Membership and Value-Added Services

Alibaba generates substantial revenue from membership fees and value-added services. These include the sale of China TrustPass memberships on 1688.com and gold supplier memberships on Alibaba.com, both of which allow wholesalers to host premium storefronts. Alibaba also offers value-added services such as product showcases and other business solutions.

Key Takeaways from the Alibaba Revenue Model

Here are some of the key takeaways from the Alibaba Revenue Model and the monetization methods they use:

Diverse Revenue Streams: Alibaba revenue model is highly diversified, with income derived from various sources such as e-commerce, cloud computing, digital media, and entertainment. This diversification mitigates risks associated with dependence on a single revenue source.

Ecommerce Dominance: Majority of Alibaba’s revenue comes from its e-commerce businesses, including platforms like Taobao and Tmall. These platforms generate revenue through advertising and transaction fees from sellers who use these platforms to reach consumers.

Growth of Cloud Computing: Alibaba’s cloud computing segment, Alibaba Cloud, has emerged as a significant revenue source. It provides various services like data storage, analytics services, machine learning, and many more to various businesses, thereby generating income.

Digital Media and Entertainment: Alibaba revenue model also includes digital media and entertainment services like video streaming platform Youku Tudou and music streaming service Xiami, generating revenue through subscription and advertising.

Customer-Centric Approach: Alibaba’s primary focus on customer experience and satisfaction has played an instrumental role in its revenue growth. By offering a wide range of products at competitive prices through their customized smartphone apps, it has successfully attracted and retained a large customer base.

Cross-Border E-commerce: Alibaba has expanded globally, especially focusing on cross-border e-commerce. It allows international brands to sell their products to China’s vast consumer market, thus earning transaction fees and boosting its revenue.

Data-Driven Strategy: Alibaba uses data analytics to understand consumer behavior better, enabling it to provide personalized customer experiences and improve its services. This data-driven strategy has helped Alibaba increase user engagement and, consequently, its revenue.

Conclusion

Alibaba revenue model and monetization strategies are a testament to its innovative and forward-thinking approach to business. The company’s diverse revenue streams, ranging from online marketing services to cloud computing, reflect its ability to adapt to changing market dynamics and consumer preferences. Crucially, Alibaba has harnessed the power of data to deepen its understanding of its vast customer base, enabling it to deliver solutions that meet its evolving needs.

Alibaba’s continued commitment to innovation and diversification, balanced with a thorough comprehension of its customers, underscores its potential for sustained growth. Alibaba’s story reaffirms the importance of continuously evolving and adapting in today’s fast-paced digital economy, and exemplifies the power of a well-designed and well-executed revenue model.