Regardless of trade deals, inflation, deflation, new construction, and real estate trends, apartment and multifamily rents keep on rising.

That means property values are good, rental ROI is good, and risk is lower than other types of investments.

The Real Estate and Rental and Leasing sector comprises establishments engaged in renting, leasing, or otherwise allowing the use of tangible (real estate, equipment) or intangible assets (patents,trademarks).

Climbing Rental Prices

According to a new report by RentCafe, the average US apartment rent reached $1,436 in April 2019. That’s 3% ($42) YoY or $5 over March rent prices.

In most cities, rents are below the national average.

- Cities in Texas saw the lowest month over month increases.

- Manhattan, San Francisco and Washington DC come in with big rent prices.

- Chicago’s rents are moderate.

- Phoenix and Las Vegas rent prices have grown 5% to 8% YoY.

- Honolulu rent prices have risen 30% YoY and 1% MoM.

- Los Angeles rent prices rose a startling $122 YoY.

- Denver rent prices actually fell slightly.

- Overall, the rental market is bullish as the economy improves.

Acording to a recent REIS report, occupancy rates are high. It was flat at 4.8% and only rose in 15 of 79 major cities. Net absorption dropped by 21.6%.

New home sales have surged to a 16 month high. Attom Data’s research shows renting is better than buying. And for investors, buying a rental property seems to be a solid idea.

Rental Property Market | A Place to Invest?

Rents keep rising in 92% of cities, however is rental property investment the place to be in 2019/2020?

Credit : Yardi Matric Monthly Rent Price Report

From Florida to California to Hawaii, the rental market remains constrained. Although prices have flattened or fallen in many areas, the revenue potential for builders and property owners is positive.

The US rental property market is a growing chunk of the now estimated $127 Trillion global real estate market. It accounts for 60% of all mainstream assets.

The rental property market is less than half of the $36+ Trillion US Real estate market, yet for small property investors it’s a fertile paradise.

15 Top Drivers of the Rental Property Market

| Buyer market is young and unable to finance the purchase of a home |

| Not enough single detached homes available to buy |

| Risks in buying are high with high prices, rising mortgage rates and housing market uncertainty |

| Millennials are career minded and not necessarily willing to buy now |

| Buyers won’t buy due to mortgage finance restrictions and long term worries over a recession/market crash |

| Rents rising too fast compared to cost of buying a home |

| Bank of mom and dad may be running out of money |

| Cost of living rising |

| Cap rates not sufficiently better than other investment options |

| Millennial preference for older urban neighborhoods with walk-ability |

| Immigration into US is still strong |

| Home and condo prices too high to purchase |

| Retiring baby-boomers having tough time places to move to |

| More good condos and apartments available because regulations are decreasing and construction techniques are better |

| The number and share of cost-burdened renters – those paying more than 30% of their income fell 2% in 2017 — meaning renting is more affordable |

America: Rental Nation Still in 2019

From New York to Los Angeles, more people were renting than owning for the first time ever. Home sales were down in 2018 due to high prices, low availability, rising interest rates, and more factors.

Adding to the power of the rental market is the rise of Airbnb and the short term rental. The success of Airbnb and VRBO tells us of changes happening in residential and commercial real estate and how it’s creating opportunities for Realtors and property managers.

Projections

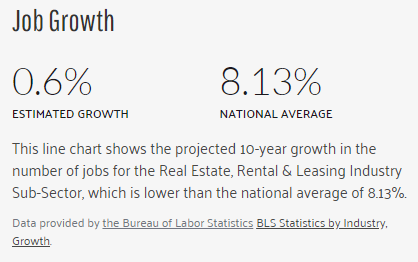

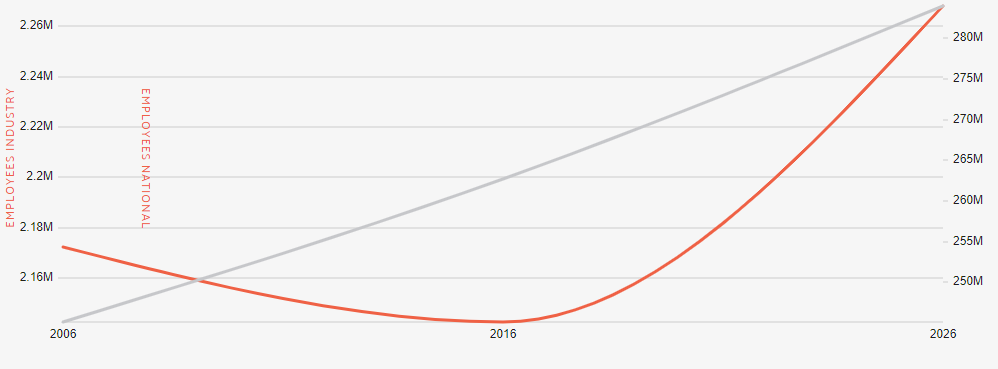

Growth projections of the Real Estate, Rental & Leasing Industry Sub-Sector is projected to grow 8.13% in the next ten years.

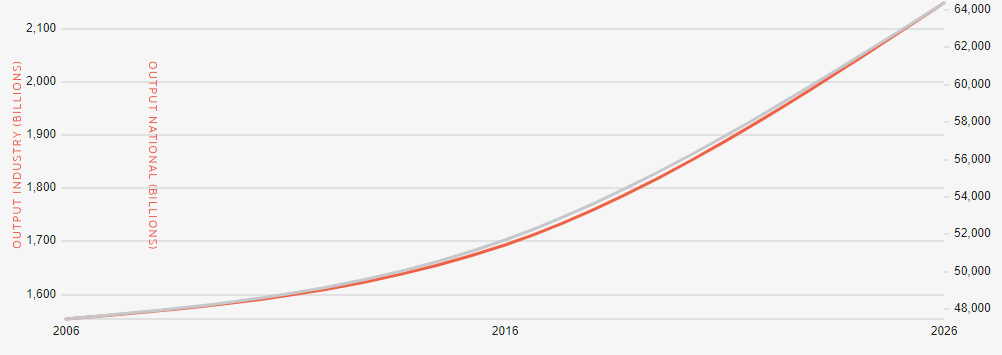

The Sub-Sector has a lower projected workforce growth at 0.6%. Its projected 10-year growth in output (2.4%) is lower than the projected national growth in output (24.6%).

Job Growth

Output Growth

Data provided by : Bureau of Labor Statistics BLS Statistics by Industry, Growth

The US property rental market is a wonderful opportunity to earn passive income or ramp up earnings with active property management.

Make sure you are utilizing the best property management software to ease your workload and create efficiencies and create sustainable cash flow.